Are Sector Funds Right for Your Portfolio?

Posted by cskadmin on February 13, 2012

Sector funds target specific industries and economic niches to seek above‐average returns. With the opportunity for greater returns comes greater risk, as these funds typically are prone to fluctuate in value more than diversified, multisector funds.1

Sector funds may invest solely in specific industries, such as utilities, technology, financial services, health care, and manufacturing. They may also invest in commodities, such as oil and gold. Additionally, there are sector funds that invest in specific international markets, such as Germany and China.

Many investors look to sector funds to gain exposure to industries that may appear to offer exceptional potential. Top‐down investors and market timers look first for industries that often perform well in certain economic cycles and then seek to predict which industry will be next in the “rotation.” Because of their higher potential volatility, it may be prudent to limit investments in individual sectors to no more than 10% of an overall equity portfolio.

Some investors choose a contrarian strategy, seeking value in sectors that have been passed over by the rest of the market. Another strategy is the tilted index. Passive investors will invest in a market index seeking to avoid the inefficiencies of picking individual stocks. By adding shares of sector funds that outperform the market, you may outperform the index overall.

Evaluating Sector Funds

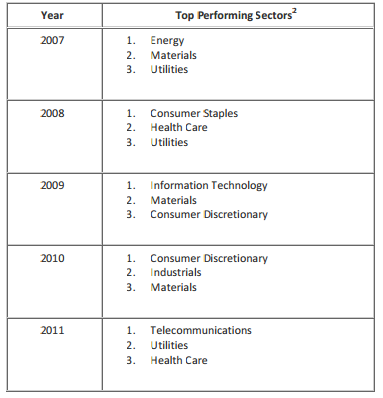

Whatever strategy you use in choosing a sector fund, be careful not to chase past returns. A high‐flying sector may be at its peak. The table below shows the top three performing sectors from the S&P 500 for the past five years. As you can see, it’s rare for one sector to lead the pack year after year.

You should also be aware that even if the name of the fund is the same, not all sector funds are alike. Stock/cash allocations, sector segment weights, top holdings, portfolio size, past performance, yield, and portfolio turnover are among the criteria used to compare funds that invest in the same sector.

- Stock/cash allocations refer to the percentage of a fund’s assets that is actually invested in the chosen sector. In addition to cash, funds may invest in bonds, or even stocks from other sectors. Although these investments may increase performance or decrease risk, you should be aware of the portfolio’s composition.

- Many sectors can be divided into subsectors and industries, and sector weight refers to the percentage of assets invested in each.

- Portfolio turnover measures trading aggressiveness and often exceeds 100% in a single year.

- Although past performance is no guarantee of future results, the longer the return period the better. Look at returns over at least a five‐year period, if available. Investors should ideally compare how funds performed in a variety of different market climates and be prepared for the volatility inherent in many sector funds.

- Yield is just one component of total return, but high yield can mean less reliance on capital gains. This often points to lower volatility.

As with any investment, be sure to get a copy of the fund’s annual report and prospectus before investing. You should also consult with your financial professional to help determine the suitability of sector funds in your overall portfolio.

Source/Disclaimer:

1 Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so you may lose money. Past performance is no guarantee of future results. For more complete information about any mutual fund, including risk, charges, and expenses, please obtain a prospectus. Please read the prospectus carefully before you invest. Call the appropriate mutual fund company for the most recent month-end performance results. Current performance may be lower or higher than the hypothetical performance data quoted. The hypothetical data quoted is for illustrative purposes only and is not indicative of the performance of any actual investments. Investment return and principal value will fluctuate, and shares when redeemed, may be worth more or less than their original cost. Diversification does not ensure a profit or protect against a loss in a declining market.

2 Source: ChartSource, McGraw-Hill Financial Communications. Sector performance is represented by the total returns of the 10 GICS

sectors within Standard & Poor’s Composite Index of 500 Stocks, an unmanaged index that is generally considered representative of the U.S. stock market. It is not possible to invest directly in an index. Past performance is no guarantee of future results.

Required Attribution

Because of the possibility of human or mechanical error by McGraw-Hill Financial Communications or its sources, neither McGraw- Hill Financial Communications nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall McGraw-Hill Financial Communications be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2012 McGraw-Hill Financial Communications. All rights reserved.