Is Increased Inflation on the Horizon?

Posted by cskadmin on February 20, 2012

Worries about inflation have been cropping up more frequently lately, largely due to escalating commodity prices, which are pushing up consumer prices, both in the United States and abroad.

Worries about inflation have been cropping up more frequently lately, largely due to escalating commodity prices,which are pushing up consumer prices, both in the United States and abroad. At the beginning of 2011, the inflation ratestood at a paltry 1.6%. By the end of the year, it had more than doubled to 3.4%.1 And this could be just the start of a longer‐term inflationary cycle. With an improving economy and soaring federal deficits, many experts feel that prices in the United States will inevitably pick up their pace even further.

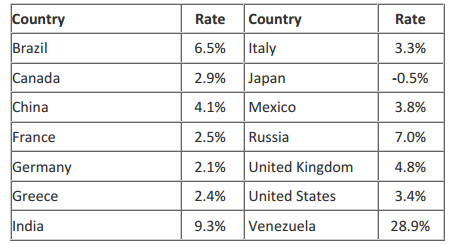

Inflation Rates Around the World (as of December 31, 2011) 2

Staying Ahead

For investors, staying ahead of inflation means choosing investments that are most likely to provide returns that outpace it. Here’s a look at how a climbing inflation rate could impact various investment types and asset classes.

- Domestic Stocks ‐‐ Although past performance is no guarantee of future returns, historically, stocks have provided the best potential for long‐term returns that exceed inflation. An analysis of holding periods between 1926 and December 31, 2011, found that the annualized return for a portfolio composed exclusively of stocks in Standard & Poor’s Composite Index of 500 Stocks was 9.83% ‐‐ well above the average inflation rate of 2.99% for the same period. However, over shorter time periods the results are not as appealing. For the 10 years ended December 31, 2011, the S&P 500 returned an average of only 2.92%, compared with an average inflation rate of 2.50%.3

- International Stocks ‐‐ During the same 10‐year span that ended December 31, 2011, the Morgan Stanley Capital International (MSCI) EAFE, which is composed of established economies such as Germany and Japan, outpaced U.S. inflation with an average return of 5.12%. The MSCI Emerging Markets index, which tracks developing world economies such as Brazil and China, was even more stellar, returning an average of 14.2%.4

- Bonds ‐‐ Historically, investors have turned to shorter‐term corporate and high‐yield bonds for protection in rising‐rate environments.5 There are two types of bonds that receive a lot of investor interest when inflation starts to rise: Treasury Inflation‐Protected Securities (TIPS) and I Savings Bonds. Both TIPS and I bonds are types of fixed‐interest rate bonds whose value rises as inflation rates rise.

- CDs and Other Cash Instruments ‐‐ The Federal Reserve is still keeping a tight lid on interest rates, forcing investors who hope to keep pace with inflation by investing in cash instruments facing a harsh reality. The rates on a one‐year CD are averaging under 1%, while a five‐year CD is yielding an average of under 2%, according to Bankrate.com. Money market and other bank savings accounts are also averaging well under 1%.6

Although many economists project overall U.S. inflation to remain modest in the near future, most see an uptick down the road. For investors, a well‐rounded portfolio may be your best weapon. The key is to consider your time frame, your anticipated income needs, and how much volatility you are willing to accept, and then construct a portfolio with the mix of investments with which you are comfortable. Consult your financial professional to discuss your specific needs and options.

Source/Disclaimer:

1 Source: U.S. Bureau of Labor Statistics, January 2012.

2 Sources: TradingEconomics.com; U.S. Bureau of Labor Statistics, January 2012.

3 Sources: Standard & Poor’s; U.S. Bureau of Labor Statistics. The S&P 500 is an unmanaged index. It is not possible to invest directly in an index. Past performance is no guarantee of future results.

4 Source: Morgan Stanley. The MSCI EAFE and MSCI EM are unmanaged indexes. It is not possible to invest directly in an index. Past performance is no guarantee of future results.

5 Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and are subject to availability and change in price.

6 Source: Bankrate.com, January 20, 2012.

Required Attribution

Because of the possibility of human or mechanical error by McGraw-Hill Financial Communications or its sources, neither McGraw-Hill Financial Communications nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall McGraw-Hill Financial Communications be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2012 McGraw-Hill Financial Communications. All rights reserved.