Strategies for Financing Your Business

Posted by cskadmin on February 23, 2012

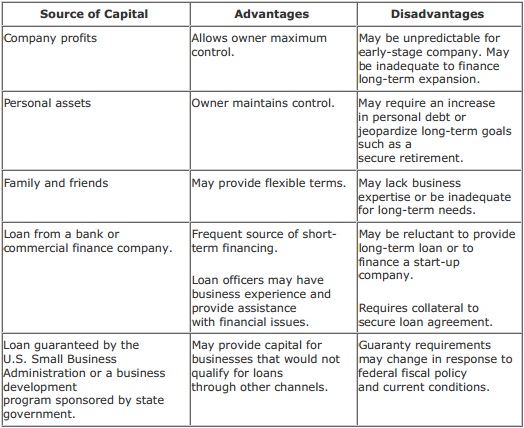

Resources for financing a business may include company profits, your personal assets, help from family and friends, a loan from a bank or commercial finance company, and others.

A comprehensive financing strategy, including estimates of the capital required for short- and long-term needs, is a key element in growing your business. A long-term plan reinforces shortterm spending discipline and reduces the likelihood your business will burn through capital too quickly. The time to create a capitalization strategy is before your business reaches a financing benchmark. You are more likely to impress potential lenders or investors if your financial affairs are in order and you have a firm grasp of your company’s long-term needs.

Creating a capitalization strategy requires an understanding of business activities your company plans to finance, estimates of how much these activities will cost, and knowledge of appropriate sources of financing.

The state of the economy and your management skills also influence your company’s need for capital. The prolonged economic downturn has reduced sales and profits for many entrepreneurs, often requiring business owners to scale back operations, cut their own salaries, and extend payment cycles for customers who also are feeling the pinch.

Doing the Numbers

Once you understand the business activity you need to finance, you can develop an annual budget and estimate your capital requirements one and two years hence. Your accountant can help with this exercise. Many experts recommend planning for worst-case, realistic, and best-case scenarios. This approach may decrease your likelihood of underestimating your capital requirements, running out of money, or passing up potential opportunities.

After researching your capital needs, you are ready to consider potential sources of funding. The table below explains sources that entrepreneurs frequently use and the characteristics associated with each.

If you are estimating capital needs for a start-up business, plan on maintaining sufficient funding to cover anticipated expenses for at least six months. Most start-up businesses are not profitable and typically operate six months or longer before generating capital internally.

Also, the type of business you manage will influence your capital requirements. For example, a retail business requires inventory that must be financed before taking delivery. Many service businesses typically wait between 30 and 90 days before receiving payment from customers, which may require an infusion of capital to pay interim expenses.

Required Attribution

Because of the possibility of human or mechanical error by McGraw-Hill Financial Communications or its sources, neither McGraw-Hill Financial Communications nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall McGraw-Hill Financial Communications be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2012 McGraw-Hill Financial Communications. All rights reserved.