Strategies for Managing Volatility

Posted by cskadmin on July 2, 2012

Asset allocation, diversification, and the use of dividend-paying stocks are potential strategies for reducing volatility.

Investors are exposed to financial risk in two ways: company-specific risk or market risk. Long-term investors can reduce exposure to company-specific risk by diversifying among many different securities within the same asset class.1 Market risk is managed, but not eliminated, by holding investments in several different asset classes.

Low Correlation: The Key to Effective Asset Allocation

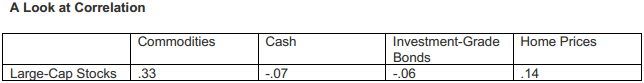

Longer term, the market risk associated with an individual asset class, such as stocks, may be reduced by allocating a portion of a portfolio’s assets to other types of investments that historically have reacted differently to market and economic events.2 A statistic known as correlation measures the tendency of two investments to move together. A correlation close to zero indicates that two investments are largely independent of each other. The closer a correlation is to 1.00, the greater the tendency two investments

have had to move in tandem. The table below lists four assets that have had relatively low correlations with U.S. stocks during the past decade. Past performance does not guarantee future results.

Sources: S&P Capital IQ Financial Communications; Barclays Capital. Large-cap stocks are represented by the S&P 500 Index, commodities by the Standard & Poor’s GSCI®, cash by the Barclays 3-Month Treasury Bill Index, investment-grade bonds by the Barclays Aggregate Bond Index, home prices by the S&P/Case-Shiller 20-City Composite Home Price Index. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and are subject to availability and change in price. Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest, and if held to maturity, offer a fixed rate of return and fixed principal value. Exposure to the commodities markets may subject investors to greater volatility as commodity-linked investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity. You cannot invest directly in an index. Past performance is not a guarantee of future results. Data is based on the 10-year period ending December 31, 2011.

Managing Single-Security Risk

Modern portfolio theory is founded on the assumption that investment markets do not reward investors for taking on risks that could be eliminated though diversification. A 2003 study found that at least 50 stocks may be required to provide adequate diversification for an equity portfolio.3

Fortunately, there are many strategies available for diversifying a stock portfolio. Investors can allocate portions of a portfolio to domestic and international stocks, which may take turns outperforming depending on circumstances in various global economies.4 An allocation to small-cap, midcap, and largecap stocks also provide exposure to companies of various sizes. Although there are no guarantees, smaller companies may be nimble enough to exploit untapped market niches and capitalize on growth

potential.5

Dividend Strategies

In addition, equity investors looking to limit volatility may want to consider dividend-paying stocks. Although a company can potentially eliminate or reduce dividends at any time, a dividend may provide something in the way of a return even when stock prices are volatile. When evaluating dividend-paying stocks, it may be worthwhile to review how long a company has paid a dividend and whether the dividend has increased over time. According to a study by Standard & Poor’s, firms that had increased their

dividends for the past 25 years outperformed the S&P 500 and also were less volatile during the 5-year, 10-year, and 15-year periods ending December 31, 2011. Past performance does not guarantee future results.6 When investing in dividend-paying stocks, be aware that tax rates on qualified dividends are scheduled to increase in 2013 unless Congress changes the tax laws.

For investors interested in managing volatility, asset allocation with low-correlation investments, diversification, and dividend-paying stocks may be worth considering.

1 There is no guarantee that a diversified portfolio will enhance overall returns or outperform a nondiversified portfolio. Diversification does not ensure against market risk.

2 Asset allocation does not assure a profit or protect against loss.

3 Source: H. Christine Hsu and H. Jeffrey Wei, “Stock Diversification in the U.S. Equity Market,” 2003.

4 Foreign stocks involve greater risks than U.S. investments, including political and economic risks and the risk of currency fluctuations, and may not be suitable for all investors.

5 Securities of smaller companies may be more volatile than those of larger companies. The illiquidity of the small-cap market may adversely affect the value of these investments.

6 Source: Standard & Poor’s. Returns are based on the Standard & Poor’s Dividends Aristocrats portfolio. Volatility is measured by a statistic known as standard deviation. Past performance does not guarantee future results.

——————–

Because of the possibility of human or mechanical error by S&P Capital IQ Financial Communications or its sources, neither S&P Capital IQ Financial Communications nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall S&P Capital IQ Financial Communications be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2012 S&P Capital IQ Financial Communications. All rights reserved.