Are Your Social Security Benefits Taxable?

Posted by Richard on February 19, 2014

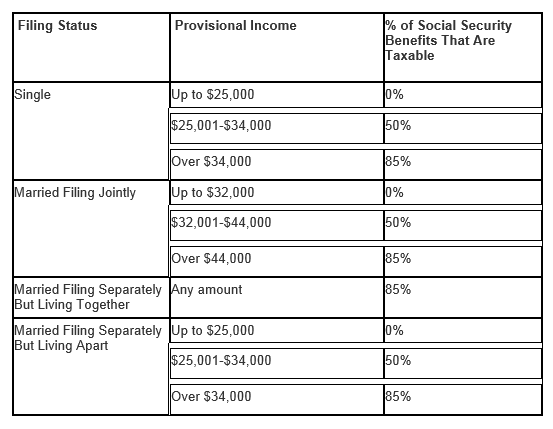

Many people don’t realize that they can be taxed on their Social Security benefits. The amount that could be federally taxable is based on your filing status and your “provisional income.” Your provisional income is determined by taking the sum of your wages, dividends, taxable and tax-exempt interest, pensions, and taxable retirement plan distributions. Added to that sum is half of your annual Social Security benefits as well as self-employment and other taxable income, less certain deductions (for example, for those with foreign income or housing).

Your entire Social Security benefit isn’t taxed, just the amount that falls over the threshold. If you think you may be subject to federal taxes on your benefits, check out IRS Publication 915. The publication contains worksheets that will help you determine the taxable portion of your benefit.

Here’s how to limit potential taxes on your benefits.

- Watch your retirement account distributions. Take too much from your retirement accounts (outside of your minimum required distribution if you are over age 70 ½) and you could trigger a tax on your Social Security benefits. Note that Roth distributions are not part of the provisional income calculation.

- Be mindful of investing in tax-exempt investments, such as municipal bonds. The interest earned from tax-exempt investments is used as part of the calculation to determine your taxable Social Security income.

- If you are married and file separately, consider changing your filing status. Currently, any couple that is married and lives together but files separately subjects 85% of their Social Security benefits to taxes.

Also note that residents of the following countries are exempt from taxes on their benefits: Canada, Egypt, Germany, Ireland, Israel, Italy, Japan, Romania, and the United Kingdom.

States That Tax Social Security

Currently, there are 14 states that tax Social Security benefits. They are: Colorado, Connecticut, Iowa, Kansas, Nebraska, Minnesota, Missouri, Montana, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. Starting with the 2014 tax year, Iowa will no longer tax Social Security.

If you live in any of the above states, or think you may have to pay federal taxes on your benefit, consult with an accountant.

Required Attribution

Because of the possibility of human or mechanical error by Wealth Management Systems Inc. or its sources, neither Wealth Management Systems Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall Wealth Management Systems Inc. be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2014 Wealth Management Systems Inc. All rights reserved.