Sequence of Returns – A Critical Factor in Shaping Your Retirement Outlook

Posted by Richard on September 2, 2014

One of the key determinants of retirement income planning is the expected rate of return on your investments. Conventional analysis typically relies on long-term performance averages to gauge a retiree’s spending limits. Increasingly, however, planning experts say that for those who are withdrawing from a portfolio, it is not just the average rate of investment return that is important.

In fact, the sequence of those returns may be just as, if not more, critical to your portfolio’s long-term success. In other words, over time, “average” returns will include both bull markets and bear markets. Yet once withdrawals begin, it is far better to have poor years occur later in retirement than earlier.

The timing of returns is becoming a more critical issue now as greater numbers of Americans move into retirement and begin spending down assets.

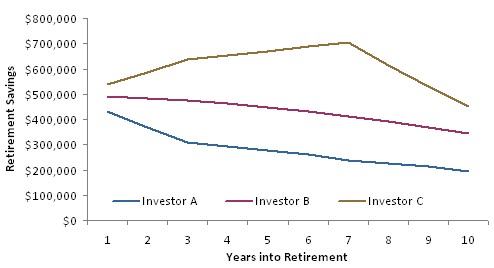

To better understand how the sequence of returns works together with your withdrawal rate and inflation to potentially affect the longevity of your retirement portfolio, consider the hypothetical example in the chart below. It illustrates three different investment scenarios, each assuming an average annualized rate of return of 6% over a 10-year period.*

Investor A retired at age 65 with savings worth $500,000. He plans to withdraw 7% of his starting account value each year, which is adjusted annually for 3% inflation. Investor A’s investments got off to a poor start with three straight years of negative performance. When he factors in his 7% annual withdrawals, in addition to the poor performance, he will have depleted more than half of his original principal value in just 10 years.

Investor B experienced a steady 6% rate of return over 10 years. After factoring in his 7% withdrawals, his portfolio would be worth considerably more after 10 years than Investor A’s — $373,895 versus $229,109 — but such consistent market performance over an extended time period is unrealistic.

Investor C’s scenario is identical to the first two investors — with one important exception. The investor experiences seven straight years of positive returns at the onset of retirement followed by three years of negative performance. As the chart indicates, the portfolio would have declined to $479,744 after 10 years, just $20,256 less than its original principal value, despite annual 7% withdrawals.

Since market performance and inflation are variables that cannot be controlled, it is up to individuals to be realistic and conservative in setting a distribution rate for income-producing portfolios. The consensus from financial planners and academics suggests that a “sustainable” withdrawal rate may be no more than 4% to 5% of the account’s starting value, adjusted regularly for inflation.

Source/Disclaimer:

*Source: Standard & Poor’s. This example is hypothetical and is for illustrative purposes only. It assumes a 6% annualized rate of return, rounded to the first decimal, and 7% annual withdrawal based on the first-year principal, adjusted thereafter for 3% inflation each year. Actual results will vary. Past performance does not guarantee future results.

Required Attribution

Because of the possibility of human or mechanical error by Wealth Management Systems Inc. or its sources, neither Wealth Management Systems Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall Wealth Management Systems Inc. be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2014 Wealth Management Systems Inc. All rights reserved.