Are There Any Disadvantages Associated with Paying Off a Mortgage Early?

Posted by Richard on June 9, 2015

The disadvantages, if any, may stem from the financial trade-offs that a mortgage holder needs to make when paying off the mortgage. Paying it off typically requires a cash outlay equal to the amount of the principal. If the principal is sizeable, this payment could potentially jeopardize a middle-income family’s ability to save for retirement, invest for college, maintain an emergency fund, and take care of other financial needs.

If you have the financial means to pay off a mortgage, consider the following:

- Your feelings about debt — Some homeowners like the feeling of security that comes with owning a home free and clear. If this describes you, it may be to your benefit to pay off or reduce the size of your mortgage. Should conditions in your local real estate market decline, there’s less of a chance of owing more than you own.

- Your timeline until retirement — If your mortgage is relatively small, you may be able to invest the money formerly used for mortgage payments for retirement or other long-term goals. Your timeline until retirement may be a factor when making this decision. With 10 years or more remaining until you expect to retire, you could have time to build a nest egg if you invest the money formerly used to pay a mortgage. If you plan to retire sooner, entering retirement without a mortgage could provide you with more flexibility during your later years.

- Your tax savings — Mortgage interest typically is tax deductible. During the early years of a mortgage, when the interest payments are highest, many homeowners benefit from a sizeable deduction. This could be important if you are in a higher tax bracket. If your interest payments are relatively low, the tax savings could be less of a factor.

- Your future plans — Owning a home outright could be an advantage if you plan to sell it during the next few years. You could potentially leave your existing residence with more home equity.

- Your overall debt load — If you are carrying other forms of debt, such as credit card balances or a college loan, consider whether you could benefit from paying off other debt first before reducing or eliminating your mortgage.

There is no “right” answer for everyone when it comes to potentially paying off a mortgage. Consider your feelings about debt, your timeline with respect to long-term goals, your tax savings, and other factors before making a decision that is in your best interest.

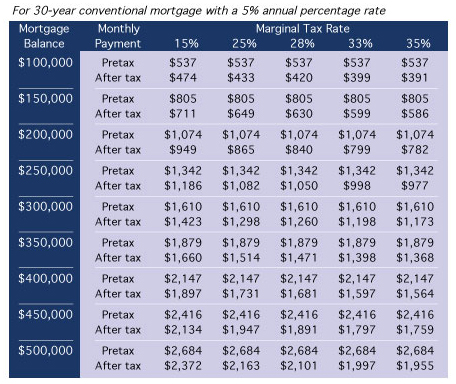

After-Tax Value of Home Mortgage Deduction

One of the big benefits of home ownership is the mortgage interest deduction. The federal government lets you deduct mortgage interest on a first or second home, up to $1 million per year.

Source/Disclaimer:

Source: Wealth Management Systems Inc. Monthly payments assume a conventional 30-year fixed-rate mortgage at 5% APR, excluding escrows for taxes, insurance, or other fees. Mortgage deductions are based on first month’s interest. Assumes that other deductions exceed the standard deduction. (CS0000218)

Required Attribution Because of the possibility of human or mechanical error by Wealth Management Systems Inc. or its sources, neither Wealth Management Systems Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall Wealth Management Systems Inc. be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2015 Wealth Management Systems Inc. All rights reserved.