In Volatile Markets, Investors May Find Comfort in Dividends

Posted by cskadmin on February 27, 2012

As uncertainty at home and abroad roils the financial markets, income‐minded investors seeking protection from the bumpy road ahead may find dividend‐paying stocks offer an attractive mix of features and warrant a place in their equity portfolios.

The appeal is simple: Dividend‐paying stocks can provide investors with tangible returns on a regular basis regardless of market conditions.

The Benefits of Dividend‐Paying Stocks

If you own stock in a company that has announced it will be issuing a dividend, or if you are proactively considering adding an allocation to dividend‐paying stocks, history provides compelling evidence of the long‐term benefits of dividends and their reinvestment.

- A sign of corporate financial health. Dividend payouts are often seen as a sign of a company’s financial health and management’s confidence in future cash flow. Dividends also communicate a positive message to investors who perceive a long‐term dividend as a sign of corporate maturity and strength.

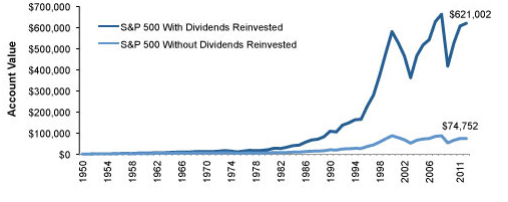

- A key driver of total return. There are several factors that may contribute to the superior total return of dividend‐paying stocks over the long term. One of them is dividend reinvestment. The longer the period in which dividends are reinvested, the greater the spread between price return and dividend reinvested total return.

- Potentially stronger returns, lower volatility. Dividends may help to mitigate portfolio losses when stock prices decline, and over long time horizons, stocks with a history of increasing their dividend each year have also produced higher returns with considerably less risk than non‐dividend‐paying stocks. For instance, since 1990,the S&P 500 Dividend Aristocrats ‐‐ those stocks within the S&P 500 that have increased their dividends each year for the past 25 years ‐‐ produced annualized returns of 11.04% vs. 8.23% for the S&P 500 overall, with less volatility (14.14% vs. 15.22%, respectively).1

The Growth of Dividend‐Paying Stocks, 1950‐2011 2

If you are considering adding dividend‐paying stocks to your investment mix, keep the following thoughts in mind.

- Dividend‐paying stocks may help diversify an income‐generating portfolio. Income‐oriented investors may want to diversify potential sources of income within their portfolios. Given current realities present in the bond market, stocks with above‐average dividend yields may compare favorably with bonds and may act as a buffer should conditions turn negative within the bond market.

- Dividends benefit from continued favorable tax treatment. The extension of the Bush‐era tax cuts helps to reinforce the current case for dividend stocks. The tax bill that passed in late 2010 extended the 15% tax on qualifying dividends and other forms of investment income through December 31, 2012.

Note that dividends can be increased, decreased, and/or eliminated at any time without prior notice.

Source/Disclaimer:

1 Volatility is measured by standard deviation. Past performance is no guarantee of future results.

2 Source: Standard & Poor’s. Stocks are represented by the S&P 500, an unmanaged index considered representative of the broad U.S. stock market. For the period January 1, 1950, through December 31, 2011. Past performance is not indicative of future results. Investors cannot invest directly in any index.

Required Attribution

Because of the possibility of human or mechanical error by McGraw-Hill Financial Communications or its sources, neither McGraw-Hill Financial Communications nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall McGraw-Hill Financial Communications be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2012 McGraw-Hill Financial Communications. All rights reserved.